Saturday, July 30, 2022

Nano Banc in Calif. adds new CEO, chairman

Friday, July 29, 2022

U.S. Bancorp to pay $37.5M fine over fake accounts

Blue Ridge Bankshares has update on fintech, mortgages

Heritage Commerce in California selects next CEO

Red River Bancshares in La. to open New Orleans branch

Thursday, July 28, 2022

Tech upgrades in works at several community banks

FDIC approves proposed de novo in S. Florida

Customers in Pa. makes progress with digital assets push

How a small Ohio bank pulled in 10 buyout offers

Wednesday, July 27, 2022

Heritage Southeast to sell to First Bancshares in Miss.

Sturgis Bancorp in Mich. names new bank leadership

Grasshopper in NY signs up initial BaaS client

BayFirst adds new SBA product, hires mortgage team

Finward closes two branches, reinvesting in digital

Investar to sell two branches in south Texas

BaaS drives deposit growth at New York Community

Hanover Bancorp to expand onto Long Island

Ford's FDIC application sheds light on ILC plans

Tuesday, July 26, 2022

Trustmark in Miss. pursuing business lines, tech upgrades

NSTS Bancorp in Illinois names new bank CEO

Mark Hoppe to retire as Fifth Third regional president

Genesis Bank in Calif. launches escrow division

Ford applies for industrial loan charter

Bank First to buy Hometown Bancorp in Wisconsin

Somerset Savings to convert, buy Regal Bancorp

Monday, July 25, 2022

NBT Bancorp to buy insurance agency in northwestern NY

A look at which banks have received ECIP funds

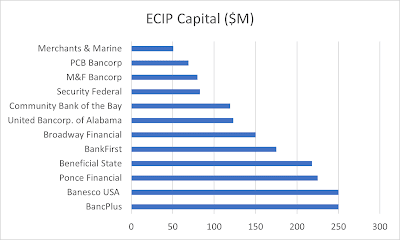

Several banking companies have disclosed the receipt of capital from the Treasury Department's Emergency Capital Investment Program (ECIP).

The Treasury invested nearly $1.8 billion between late April and late July, according to data compiled by Performance Trust Capital Partners. The banks are issuing preferred stock in exchange for the fresh capital.

Security Federal in Aiken, S.C.; BancPlus in Ridgeland, Miss.; Broadway Financial in Los Angeles; and Ponce Financial Group in Bronx, N.Y., are among the companies that issued releases about their ECIP funding.

This chart includes more banking companies that have benefited from the program.

The Treasury set aside $8.7 billion to invest in Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) through the ECIP.

The capital will help those institutions provide loans, grants and forbearance for small and minority-owned businesses, as well as consumers in low-income and underserved communities.

Alpine Banks of Colo. raises $34M in private placement

National Bank in Denver invests in B2B payments firm

Citizens becomes official bank of NFL's Giants

MainStreet in Va. plans to debut BaaS product in 4Q

HomeTrust in NC to enter Atlanta with Quantum deal

Sunday, July 24, 2022

Trustar in Va. raises capital with expansion in mind

Friday, July 22, 2022

Customers to close five branches in Pennsylvania

How F.N.B. landed a deal for NC bank

Thursday, July 21, 2022

Home in Ark. saw 'mini mutiny' of Happy State employees

Patriot National, American Challenger call off merger

Vermont de novo receives conditional FDIC approval

Amerant boosted stake in mortgage company in 2Q

Live Oak adds mortgage company CEO to its board

Wednesday, July 20, 2022

Citizens State parent to buy First Savanna in Illinois

Signature in NY to tap brakes on CRE lending

BMO to buy environmental strategies firm

Business First to raise $47M through stock offering

Business First Bancshares in Baton Rouge, La., plans to raise about $46.8 million from selling common stock. The $5.5 billion-asset company...

-

First Missouri Bank in Brookfield has a new name. The $377 million-asset bank has rebranded as Verimore Bank in a move that deemphasizes lo...

-

Bank of the Lowcountry in Walterboro, S.C., has a new CEO. The $269 million-asset bank said in a LinkedIn post on Friday that it had hired...

-

MainStreet Bankshares in Fairfax, Va., is in the process of bringing on its first Banking-as-a-Service customer. The $1.8 billion-asset co...