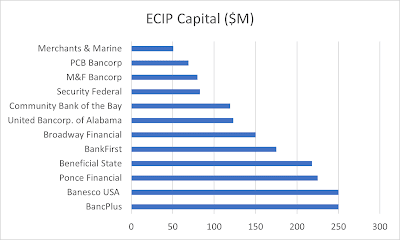

Several banking companies have disclosed the receipt of capital from the Treasury Department's Emergency Capital Investment Program (ECIP).

The Treasury invested nearly $1.8 billion between late April and late July, according to data compiled by Performance Trust Capital Partners. The banks are issuing preferred stock in exchange for the fresh capital.

Security Federal in Aiken, S.C.; BancPlus in Ridgeland, Miss.; Broadway Financial in Los Angeles; and Ponce Financial Group in Bronx, N.Y., are among the companies that issued releases about their ECIP funding.

This chart includes more banking companies that have benefited from the program.

The Treasury set aside $8.7 billion to invest in Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) through the ECIP.

The capital will help those institutions provide loans, grants and forbearance for small and minority-owned businesses, as well as consumers in low-income and underserved communities.

No comments:

Post a Comment